Pas de contenu pour la clé PAGE_CGP_TITRE

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_TITRE

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_DESCRIPTION

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_PRESUBTITRE2 Pas de contenu pour la clé PAGE_CGP_DEMARCHE_SUBTITRE2

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_PARAGRAPHE2

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_PRESUBTITRE3 Pas de contenu pour la clé PAGE_CGP_DEMARCHE_SUBTITRE3

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_PARAGRAPHE3

Pas de contenu pour la clé PAGE_CGP_DEMARCHE_SLOGAN

Pas de contenu pour la clé PAGE_CGP_OFFRE_TITRE

Pas de contenu pour la clé PAGE_CGP_OFFRE_DESCRIPTION

La prise en compte de critères ESG dans la construction et la gestion de nos portefeuilles concerne désormais toutes les équipes de Lazard Frères Gestion. Nos processus de travail ont été profondément modifiés pour intégrer les dimensions E, S et G de manière effective, répondre aux nouvelles réglementations et satisfaire les demandes de nos clients.

G Gamme de fonds ouverts

Une gamme complète d’OPC couvrant un large éventail de classes d’actifs et reflétant nos expertises est accessible par le biais de la plupart des plates-formes bancaires et d’assurances. Un partenariat avec certains groupements et réseaux de franchisés est également à votre disposition.

Pas de contenu pour la clé PAGE_CGP_OFFRE_PUCE1PARAGRAPHE2

| Crédit | Convertibles International |

|---|---|

|

Lazard Credit Opportunities (Multi Classes d’actifs obligataires)

Lazard Credit Fi SRI (Dettes subordonnées financières) |

Lazard Convertible Global |

G Gestion profilée

Notre offre s’appuie sur l’expertise de Lazard Frères Gestion en gestion diversifiée. Nous pilotons l’allocation d’actifs et la sélection de fonds en architecture ouverte au sein de chaque profil.

Nous conseillons différents profils du plus défensif au plus agressif.

| PROFIL LATITUDE | PROFIL FLEXIBLE | PROFIL ÉQUILIBRE | PROFIL DYNAMIQUE |

|---|---|---|---|

|

Assureur : Vie Plus |

Assureur : La Mondiale / Nortia |

Le PER Generali |

Le PER Generali |

G Gestion sur mesure

Nous vous proposons un accès à l’ensemble des expertises des pôles de gestion du groupe au travers de mandats de gestion et de fonds sur-mesure pour vos clients ou groupes familiaux. L’allocation d’actifs et la sélection des titres vifs ou fonds sont pilotées en continu avec de larges marges de manœuvre.

Pas de contenu pour la clé PAGE_CGP_OFFRE_SLOGAN

La politique monétaire ultra accommodante de la BCE peut-elle soutenir la croissance économique de la zone euro ?

Le 31/03/2016

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent vestibulum dignissim eros, ut congue.

Le face à face a opposé Jacques Sapir, économiste, directeur d’études à l’EHESS et Régis Begué, directeur de la Gestion Actions et de la recherche Actions chez Lazard Frères Gestion. - Intégrale Placements, du mardi 29 mars 2016, présenté par Guillaume Sommerer, sur BFM Business.

Fed : une mauvaise habitude ?

Le 23/03/2016

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Praesent vestibulum dignissim eros, ut congue.

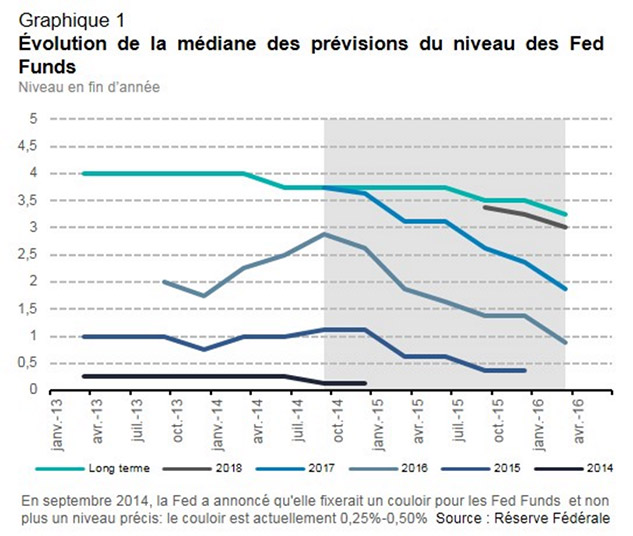

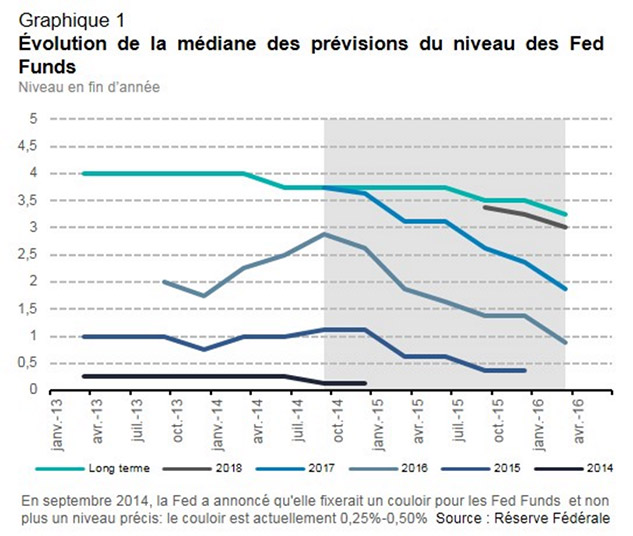

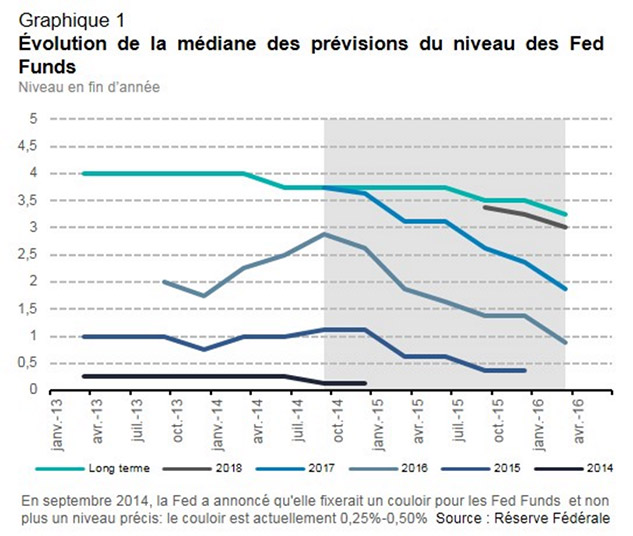

Si aucun mouvement de hausse des taux n’était attendu lors de cette réunion, le comité de politique monétaire et sa présidente Janet Yellen ont néanmoins réussi à surprendre le marché en adoptant une position très « dovish », que ce soit dans son discours ou, plus concrètement, en abaissant les anticipations sur les taux directeurs du « dots plot ». Là où celle-ci impliquait quatre hausses pour l’année 2016, elle n’en implique plus que deux. Sur les années suivantes, il n’y a pas de rattrapage puisque le rythme de quatre hausses par an est maintenu. En revanche, le niveau de long terme est encore abaissé à 3,25%. Le comité de politique monétaire a revu à la baisse ses prévisions de manière continue depuis fin 2014 (voir graphique 1).

Une nouvelle révision en baisse de la trajectoire des Fed Funds

Comme à chaque fois, le marché a amplifié la baisse de ses anticipations sur la trajectoire des taux directeurs. Entre le jour précédent et le jour suivant la réunion de la Fed, la probabilité implicite dans les prix de marché de n’observer aucune, ou seulement une hausse des taux, est passée de 58% à 75%. Si la Fed espérait gagner en crédibilité en présentant des prévisions plus proches du marché, c’est un échec.

La Réserve Fédérale entend donc maintenir une politique toujours très accommodante, alors même que selon certains modèles classiques, comme ceux dérivés de la règle de Taylor (voir graphique 2), les taux des Fed Funds auraient dû commencer à remonter à partir de début 2014 pour se situer actuellement entre 3,5% et 5% selon les différentes estimations. Bien sûr, ces modèles ne sont sans doute pas totalement adaptés au contexte d’une sortie d’une récession et d’une crise financière exceptionnelle, mais même le modèle de contrôle optimal, mis en avant par Janet Yellen pendant un certain temps, montrait que la Réserve Fédérale aurait dû commencer à remonter ses taux mi-2014 pour les amener à 1,75% au premier trimestre 2016…

Les propos tenus par Janet Yellen lors de la conférence de presse ont renforcé le message « dovish ». Il apparaît donc que la volatilité des marchés des derniers mois, le durcissement des conditions financières ainsi que les inquiétudes sur la conjoncture dans le reste du monde ont pris le pas sur la vigueur du marché de l’emploi et sur les premiers signes d’accélération des salaires et de l’inflation. Cette dernière évolution a d’ailleurs été relativisée par Janet Yellen qui l’a attribuée à des facteurs transitoires.

Un scénario économique jugé très incertain

Les prévisions de croissance ont été marginalement revues en baisse en 2016 et 2017 à +2,2% et +2,1% respectivement (quatrième trimestre en glissement annuel). Le niveau de croissance de long terme est de +2,0%. Le taux de chômage devrait continuer de baisser progressivement pour atteindre 4,7% en fin d’année, puis 4,5% fin 2018. Le niveau d’équilibre est abaissé à 4,8%. Les prévisions d’inflation Core n’ont quant à elles pas été révisées.

Les remarques plus qualitatives de Janet Yellen montrent que la croissance reste très solide dans un environnement compliqué, mais que le marché du travail peut encore s’améliorer.

Pour résumer, la Fed anticipe une croissance stable par rapport à 2015 qui devrait permettre une poursuite progressive de l’amélioration du marché de l’emploi et de l’inflation. Alors qu’en décembre le comité de politique monétaire se sentait suffisamment confiant pour parler de risques équilibrés, Janet Yellen a cette fois insisté à plusieurs reprises sur l’incertitude qui caractérise l’environnement actuel, mais aussi le niveau des taux neutre sur les Fed Funds.

Une très grande prudence revendiquée

En décembre dernier, Janet Yellen avait mentionné qu’en dehors des habituels indicateurs d’activité et du marché du travail, le FOMC serait davantage attentif aux données d’inflation, tant pour les anticipations que pour les chiffres effectifs. Comme nous l’avons dit, les chiffres forts des deux derniers mois ont été relativisés (voir graphique 3). En revanche, elle a insisté sur le bas niveau d’inflation anticipé par le marché. Le breakeven 5 ans dans 5 ans, indicateur préféré de la Fed, reste à un niveau extrêmement bas à 1,5%, loin de ce qui fut son niveau moyen, autour de 2,5%, jusqu’en 2014.mis en avant par Janet Yellen pendant un certain temps, montrait que la Réserve Fédérale aurait dû commencer à remonter ses taux mi-2014 pour les amener à 1,75% au premier trimestre 2016…

Pas de contenu pour la clé PAGE_CGP_TITRE_CONTACT

Paris

25, rue de Courcelles

75 008 Paris

+33 (0)1 44 13 04 61

Bordeaux

8, rue du Château Trompette

33 000 Bordeaux

+33 (0)5 56 44 30 00

Lyon

29 place Bellecour

69 002 Lyon

+33 (0)4 72 69 95 80

Nantes

4, rue Racine

44 000 Nantes

+33 (0)2 28 08 28 78

Brussels

Blue Tower

Avenue Louise, 326

1050 Bruxelles

+32 (0)2 627 08 80

Luxembourg

39, Boulevard Royal,

L-2449 Luxembourg

+352 273 00 810